On October 20, 2011 Calibre Mining Corp. ("Calibre") (TSXV: CXB) and Alder Resources (TSX-V: ALR) ("Alder") entered into an option agreement whereby Alder can earn a 65% interest in the 3,356 hectare Rosita D concession (the "Property") located within Calibre's 100%-owned Borosi concessions in northeast Nicaragua. Located within the Property is the historic Santa Rita open pit copper-gold mine and the Bambana copper-gold prospect.

Under the terms of the option agreement, Alder can earn a 65% interest in the Rosita D concession by expending a total of CDN$4.0 million on exploration and other work on the Property and by issuing to Calibre a total of 1,000,000 common shares of Alder over a 4 year period. Alder will be acting as the project operator for all work conducted on the Property during the option period with the first year exploration commitment being CDN$500,000. Upon Alder earning a 65% interest in the Property a joint venture will be formed with Calibre and Alder being responsible for their pro-rata share of all subsequent project expenditures.

Today, May 09, 2012 Alder Resource announced the results of an inferred resource estimate on the stock piles at Rosita in northeast Nicaragua. Please see the Alder Resources Ltd News Release below.

ALDER REPORTS 108 MILLION POUNDS COPPER, 118,000 OUNCES GOLD

AND 2.3 MILLION OUNCES SILVER IN INFERRED

STOCKPILE MINERAL RESOURCE AT ROSITA IN NICARAGUA

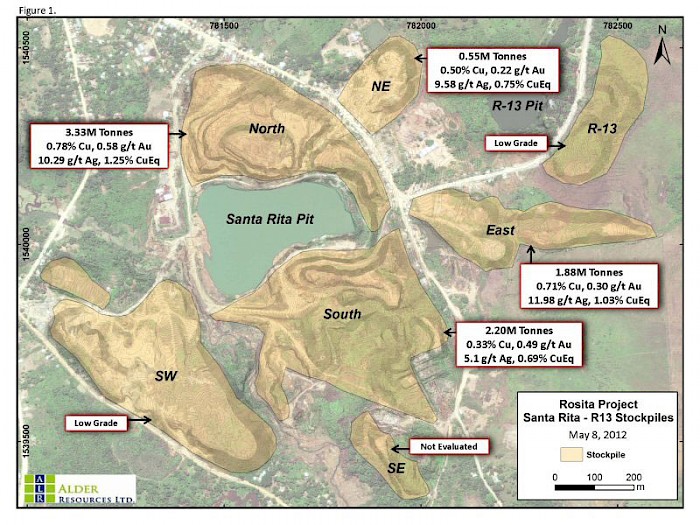

Toronto, Ontario - Alder Resources Ltd. (“Alder” or the “Company”) (TSXV:ALR) is pleased to announce the results of an independent National Instrument (“NI”) 43-101-compliant inferred resource estimate for the stockpiles at Rosita, the Company’s flagship property in northeast Nicaragua. The resource estimate totals 108.5 million pounds (“lbs.”) copper (“Cu”), 118,500 ounces (“ozs”) gold (“Au”) and 2.35 million ozs silver (“Ag”) contained within 7.95 million tonnes. This resource is based on a cutoff of 0.15% copper equivalent (“CuEq”), and averages 0.62% Cu, 0.46 g/t Au and 9.21 g/t Ag, for a 1.01% CuEq. Results are summarized in Table 1 and illustrated in Figure 1. This resource estimate was prepared by Yungang Wu, Resource Geologist of Toronto-based consulting firm Coffey Mining Pty. Ltd. (“Coffey”) and an independent Qualified Person under NI43-101, and is based on 17 vertical channel samples and 55 reverse circulation drill holes completed by Alder over the stockpiles during late-2011 and the first quarter of 2012.

Table 1. Inferred Mineral Resources Estimate as at May 8, 2012

STOCKPILE |

TONNES (Mt) |

COPPER (Mlbs) |

GOLD (oz) |

SILVER (oz) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

| NORTH | 3.33 | 56.99 | 62,100 | 1,100,900 | 0.78 | 0.58 | 10.3 | 1.25 |

| SOUTH | 2.20 | 16.16 | 34,700 | 360,000 | 0.33 | 0.49 | 5.1 | 0.69 |

| NE | 0.55 | 6.06 | 3,800 | 168,300 | 0.50 | 0.22 | 9.6 | 0.75 |

| EAST | 1.88 | 29.33 | 17,900 | 725,100 | 0.71 | 0.30 | 12.0 | 1.03 |

| TOTALS | 7.95 | 108.54 | 118,500 | 2,354,300 | 0.62 | 0.46 | 9.2 | 1.01 |

CuEq = Cu% + Au g/t x (0.6033) + Ag g/t x (0.012) and US$2.90/lb Cu, US$1200/oz Au and US$24/oz Ag.

Notes on Mineral Resource Estimation

- The mineral resource estimate base case is reported at a 0.15% copper equivalent cut-off grade; this cut-off incorporates consideration of mining and processing cost, recoveries, commodity prices and selling cost.

- The mineral resource estimate is reported on an undiluted basis.

- The mineral resource estimate assumes a long term copper price of US$2.90/lb, a gold price of US$1,200/oz and a silver price of US$24/oz.

- Rounding as required by NI 43-101 reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

- Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper pounds as imperial pounds.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as indicated or measured mineral resources and it is uncertain if further exploration will result in upgrading them to indicated or measured mineral resources.

The stockpiles were generated from open pit mining operations carried out over a 17 year period from 1959 to 1975 from two open pits: Santa Rita and R-13. A total of 5.4 million tonnes averaging 2.06% Cu, 0.93 g/t Au and 15.08 g/t Ag were mined. Mill recovery during the early years reportedly varied from 60% to 80%, depending on the type of material processed.

Coffey has estimated the Inferred resource presented here can be converted to an Indicated Resource by drilling approximately 20 to 25 infill reverse circulation drill holes over the stockpiles, on a 50 metre by 50 metre grid to a minimum depth of 25 metres on each.

Joe Arengi, Alder‘s President and CEO, stated “These results represent a milestone achievement for Alder at its Rosita project. This resource is right at surface, and contains a reasonably good grade that adds considerable value to the Company for its shareholders, serving as a solid foundation on which to build. Going forward we believe that we can add to this tonnage with an in situ resource in the vicinity of the two open pits. It also appears that there is an excellent chance that Alder can develop a mineral resource in the Rosita tailings, where detailed grid sampling was recently completed. An on-going IP-resistivity survey continues to develop intriguing anomalies suggestive of porphyry-type Cu-Au targets at the Bambana prospect, which is located four kilometers northwest of the Santa Rita open pit and near Rosita, that will be drill tested in the coming months”.

The Rosita Project

The Rosita project is located seven kilometres north of the Primavera prospect, where Calibre Mining Corp. (“Calibre”) and B2Gold Corp. announced the discovery of significant porphyry style Au-Cu mineralization, including 261.7 metres grading 0.78 g/t Au and 0.30% Cu in a diamond drill hole (Calibre news release dated January 20, 2012). In a news release dated March 1, 2012 Alder reported results of porphyry-style mineralization that included 3.32% Cu, 0.22 g/t Au and 37.55 g/t Ag over 12.0 metres in a trench located in the Bambana area, 4 kilometres northwest of the Santa Rita pit and one kilometre southwest of two historic holes from 2010 that returned 0.43% Cu and 7.56 g/t Ag over 48.0 metres, and 0.51% Cu, 0.25 g/t Au and 10.41 g/t Ag over 11.5 metres that had intersected a similarly mineralized and altered intrusive rock.

A detailed 100 metre by 100 metre grid sampling program on the mine tailings has been completed and results are expected within the next few weeks. Bedrock mineralization continues to be tested with core drilling in the vicinity of the Santa Rita and R-13 pits with 13 holes totaling 4,152 metres completed to date. In addition, an IP-resistivity geophysical survey is ongoing that has already delineated several distinct chargeability anomalies, with 42.8 line-kilometres completed, representing approximately 60% of the proposed program. Chargeability anomalies are inferred to represent areas of disseminated sulphide mineralization that could represent porphyry-type exploration targets. Ground truthing, geologic-alteration mapping and trenching are planned for several of the anomalies that are interpreted to be robust and near-surface. Deeper targets will be selectively drill tested.

Quality Assurance/Quality Control

Samples were collected into heavy gauge plastic bags, sealed on-site, then stored at Alder’s secure Rosita field office until transported by company personnel to Inspectorate Exploration and Mining Services’ sample preparation facility in Managua. At this Managua facility, sample pulps are prepared, then air freighted to Inspectorate’s Vancouver laboratory for analysis. Each sample is analyzed for total copper using aqua regia digestion followed by an ICP analysis, which includes a 30-element geochemistry package, including silver. Soluble copper is determined for samples grading over 0.1% Cu, using dilute sulfuric acid digestion with an AA (atomic absorption) finish. Gold is determined via fire assay with an AA finish. Alder has implemented an industry standard Quality Assurance/Quality Control program that includes the insertion of certified standards, duplicates and blanks into the sample stream.

Qualified Persons

John C. Spurney, Certified Professional Geologist (CPG-11007), Vice President Exploration for Alder and a qualified person as defined by NI 43-101, has reviewed and approved the scientific and technical content of this news release.

Yungang Wu, Resource Geologist of Toronto-based consulting firm Coffey Mining Pty. Ltd. and an independent Qualified Person under NI 43-101 has prepared and authorized the release of the mineral resource estimate presented herein.

A NI 43-101 report providing details of this mineral resource estimate will be filed on SEDAR under the profile of the Company within 45 days.

About Alder Resources Ltd.

Alder is a natural resource company focused on the development of gold and base metal projects throughout Latin America. The company’s current focus is on the Rosita skarn-porphyry project in Nicaragua located 275 km northeast of Managua.

Alder Resources Ltd.

“Joseph Arengi”

Joseph Arengi

President & CEO

For further information, contact:

Alder Resources Ltd.

Joseph Arengi

416-309-4397

info@alderresources.ca

www.alderltd.ca

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding potential mineralization, reserve and resource determination, exploration results and future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Alder, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Alder has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Alder does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Figure 1.