Vancouver, British Columbia: Robert D. Brown, President and CEO of Calibre Mining Corp. (TSX-V: CXB) (the "Company" or "Calibre") is pleased to announce that the Company has executed a Letter of Intent ("LOI") with Yamana Gold Inc. (NYSE:AUY, TSX:YRI, LSE:YAU) ("Yamana") for the purchase of an undivided 100% interest in Yamana's NEN Gold-Copper Project ("NEN Project") located in the North Atlantic Autonomous Region (R.A.A.N) of Nicaragua, Central America. The NEN Gold-Copper Project is a strategic and district-scale land package of 70,976 hectares (710 sq km) of contiguous mining and exploration concessions covering the historic "Mining Triangle" of the Siuna-Rosita-Bonanza areas of northeast Nicaragua, with additional concessions under application (together the "NEN Project Concessions"). The "Mining Triangle" of Nicaragua is one of the most prolific mining districts in Central America where estimates of historical production total more than 5.0 million ounces of gold, 3.9 million ounces of silver, 158,000 tons of copper, and 106,000 tons of zinc . The NEN Gold-Copper Project includes the former La Luz Gold Mine which hosts a total estimated historic resource of 675,000 ozs gold, comprised of approximately 640,000 ozs gold from underground and 35,000 ozs gold from open pit sources, and the former Santa Rita Copper-Gold Mine which hosts a total estimated historic resource of more than 500,000 ozs gold and 160,000 tons of copper (see Historic Resources section below). In addition, more than 60 mineral prospects containing precious and base metal mineralization have been discovered on the NEN Project including epithermal gold, gold-copper skarn, copper-gold skarn and porphyry gold-copper targets.

Robert Brown, President and CEO of Calibre stated: "We are delighted to have secured a commanding land position in one of the most prolific gold producing districts in Central America. Nicaragua is a mine-friendly jurisdiction and, once the purchase from Yamana is completed, Calibre is planning an aggressive exploration program to confirm and expand the known historic gold and copper resources and to advance the numerous high priority precious and base metal targets on the property".

PURCHASE TERMS

Calibre will purchase all of the issued and outstanding shares of Yamana Gold's wholly owned Nicaraguan subsidiary Yamana Nicaragua S.A. for consideration of C$7.0 Million payable by the issuance of 12.0 million common shares of Calibre and no less than C$4.0 million cash.

Bonus Payment: Within five years from the Closing, and upon Calibre incurring directly or indirectly cumulative exploration expenditures aggregating at least C$5.0 million, and upon completion and acceptance of a National Instrument 43-101 Measured and Indicated resource within the existing NEN Project boundary, Calibre will pay Yamana, payable from time to time as new resources are defined, C$5.00 per gold equivalent ounce (gold resources plus copper resources) to a maximum total payment of C$3.5 million (700,000 ozs gold equivalent). No additional payments will be required for NI 43-101 gold equivalent resources defined on the NEN Project in excess of 700,000 gold equivalent ounces. The bonus payment will be payable, at Calibre's sole discretion, in cash or common shares of Calibre.

Bonus Warrants: Yamana will also receive 5.0 million Calibre common share purchase warrants exercisable at C$0.50 per share, and 5.0 million Calibre common share purchase warrants exercisable at C$1.00 per share. Warrants are valid for a period of five years from closing. The warrants will only be exercisable by Yamana if Calibre delineates at least 2.5 million NI 43-101 compliant ounces of gold equivalent (gold resources plus copper resources) in Measured and Indicated resource categories.

The purchase of a 100% interest in Yamana's NEN Project is subject to final legal due diligence, execution of definitive documentation, completion of the below noted financing and regulatory approval.

FINANCING

A syndicate led by Canaccord Capital Corporation with other members to be determined (collectively, the "Agents") have been engaged to sell units of Calibre (each unit consists of one common share and one half of a purchase warrant) to raise aggregate gross proceeds of up to C$8 million. The Company has also granted the Agents the option to solicit additional gross proceeds of up to C$2 million exercisable 48 hours prior to closing. Net proceeds from the Offering will be used for the acquisition, exploration and drilling of the NEN Project, and for general corporate purposes, including working capital. The financing will be subject to regulatory approval. Subject to final pricing of the equity offering, post transaction and financing, Yamana will hold approximately 10% to 12% of Calibre on an issued and outstanding basis.

NEN GOLD-COPPER PROJECT, NICARAGUA

The NEN Project is located within the North Atlantic Autonomous Region of northeast Nicaragua, approximately 240 km northeast of the capital city of Managua and 80 km west of tidewater at the port town of Puerto Cabezas. The project area consists of 70,976 hectares of mining and exploration concessions with additional concessions under application in the districts of Siuna, Rosita and Bonanza.

The project is accessible by a combination of paved and improved secondary roads from both Managua and Puerto Cabezas. The concession area itself is traversed by a series of 4WD gravel roads and foot tracks which connect outlying villages. Scheduled daily flight service from Managua is offered to the towns of Siuna and Rosita that are strategically located within the NEN Project mining and exploration concessions. Each of these population centres are either connected to the national power grid or have their own power generating facilities. Telephone and basic municipal services are also available in the two centres. In addition to the projects excellent infrastructure, Yamana has established separate exploration and development offices in both Siuna and Rosita that host office and living quarters as well as core logging and storage facilities which the Company will acquire on closing. As part of the purchase agreement with Yamana, Calibre will also acquire strategic surface rights to 273 hectares over zones of past production and historic resources at the La Luz Gold Mine and Santa Rita Copper-Gold Mine.

Historic Production

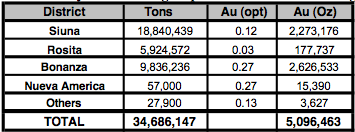

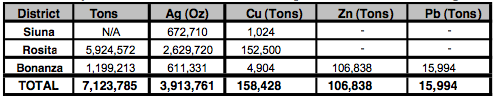

The Mining Triangle district contains several former gold and copper producers as well as one active gold mine. Gold is currently produced by a private company from the Bonanza epithermal gold concessions which are contiguous with, and surrounded by the NEN Project Concessions. Other historic gold production in the district came from the historic La Luz gold-copper skarns located at the town of Siuna, within the NEN Project Concessions. In addition, the Santa Rita copper-gold skarns located at Rosita have added significant copper and gold production to the district. Table 1 provides an estimate of the historic gold production of these and other past producers within the Mining Triangle. Table 2 provides estimates of the historical silver and base metal production.

Table 1 - Summary of estimated gold production from the Mining Triangle area1

Table 2 - Summary of estimated silver and base metal production from the Mining Triangle area1

Historic Resources

Documented past work suggests that historic gold and copper resources remain within the NEN Project at the La Luz Gold Mine in the Siuna district and in the area of the Santa Rita Copper-Gold Mine in the Rosita district.

Siuna District

Gold mineralization was first discovered in the Siuna area in the late 1800's by indigenous people that reported 'favourable results' from gold panning. The first organized, small-scale mining was carried out by the La Luz and Los Angeles Mining Company from 1908-1928, during which time an estimated 523,000 short tons grading 0.25 oz/ton gold was produced. The property was purchased in 1936 by La Luz Mines Ltd. who operated the gold mine continuously by underground and open pit methods until 1968. Production was only halted when a hurricane permanently damaged the mine's hydroelectric plant. During this period, an estimated 17 million short tons grading 0.12 oz/ton gold was produced. In recent times, only small scale mining by open pit methods was carried out by CODEMINA from 1979 -1983, during which approximately 840,000 short tons grading 0.054 oz/ton gold was produced.

Due to the unplanned shut-down of mining operations at the La Luz mine in 1968, it is believed that significant underground and open pit gold resources remain. A historic resource estimate completed at the La Luz Mine by Rosario Resources Corporation in 1974 estimates that the underground portion of the deposit contains 8.2 million tons grading 0.078 oz/ton gold , for approximately 640,000 ozs of gold. Rosario's historic resource incorporated a 0.05 oz/ton cut-off and 10% dilution. The Rosario resource pre-dates NI 43-101 standards but is believed to be relevant as the resource is based on both surface and underground drilling and underground drift sampling. However, the historic resource estimate should not be relied upon until verified. In 1997 Greenstone Resources Ltd. estimated an historic open pitable resource at the La Luz Mine of 720,000 tons grading 0.049 oz/ton gold2, totalling approximately 35,000 ozs gold. This resource also pre-dates NI 43-101 standards but is believed to be relevant as it is based on surface drilling. However, the historic resource estimate should not be relied upon until verified. Both historic resources remain open at depth and along strike. Drilling by Yamana in 2007-08 located additional gold mineralization immediately east of the historic La Luz open pit, in an area referred to as Cerro Potosi.

Rosita District

Small-scale mining of oxide gold ore by open pit methods was first carried out at Santa Rita Hill by the Eden Mining Company from 1906-1912. Total production over this period is estimated at 400,000 short tons. Intermittent exploration during the following years eventually led to La Luz Mines Ltd. establishing an open pit mining operation there in 1959. The operating mine was purchased by Rosario Resources in 1974 which continued operations until 1975, when low copper prices forced closure. During this period, 5.92 million short tons grading 0.93 g/t gold, 2.06% copper, and 15.08 g/t silver is estimated to have been produced.

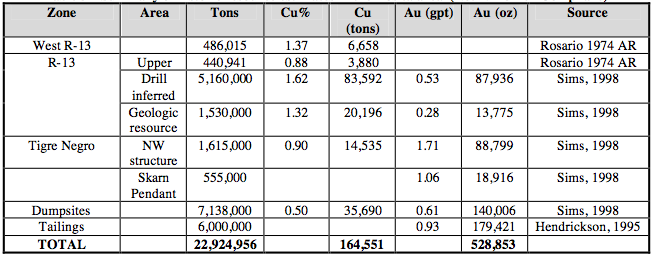

Documented past work suggests that significant gold, copper, and silver historic resources remain in three main areas at Rosita: below the Santa Rita pit, in the R-13 zone, and in the Tigre Negro area (2km NW of the Santa Rita open pit). Additional possible historic resources may exist at several dump sites and in the historic mine tailings. Past estimates suggest that the Rosita District, within the NEN Project, hosts historic resources totalling more than 500,000 ozs gold and over 160,000 tons of copper (Table 3). These historic resource calculations pre-date NI 43-101 standards but are believed to be relevant as they are based on drilling and sampling. However, the historic resource estimates should not be relied upon until verified. There is significant exploration potential in the Rosita District to expand the historic copper and gold resources.

Table 3 - Summary of historic resource estimates in the Rosita area2 (Not NI 43-101 Compliant)

Exploration Work: 2007-2008

Following the purchase of the mining and exploration concessions from RNC Gold Inc. in 2006, Yamana conducted a two stage approach to developing the area. In conjunction with drill testing of several key, high priority prospects in the Siuna district, traditional-style regional exploration was carried out in other areas to evaluate existing mineral prospects and locate new gold targets. Two of the most encouraging drill targets are the Cerro Potosi and Cerro Aeropuerto prospects, located along a 1.5 km long strike extension of the Potosi Fault near the historic La Luz Gold Mine at Siuna.

Cerro Potosi Gold-Silver-Copper Prospect

Located immediately east of the historic La Luz open pit, the Cerro Potosi prospect consists of gold-silver-copper skarn mineralization associated with epidote-rich zones containing hematite, pyrite, chalcopyrite, sphalerite, and native gold. Past work by Greenstone Resources Ltd. indicated good potential for additional economic mineralization in this area, proximal to the historic La Luz mine. Work by Yamana during 2007 and 2008 included surface geochemical sampling and drill testing of 1,465.5 m in five diamond drill holes. Numerous significant drill intercepts were returned including 7.75 g/t Au over 7.30 m, 5.21 g/t Au over 8.0 m, 1.68 g/t Au over 14.25 m, and 33.10 g/t Au over 2.00 m. Drilling was primarily designed to evaluate the possible connection of gold mineralization in the near surface at Cerro Potosi with remaining estimated historic underground resources defined by Rosario Resources in 1974 (640,000 ozs gold). The gold-rich skarn mineralization at Cerro Potosi is open for expansion along strike and to depth.

Cerro Aeropuerto Gold-Silver-Copper Prospect

The Cerro Aeropuerto prospect is located approximately 1.1 km south of the Cerro Potosi prospect and along strike of the Potosi Fault. Gold and copper mineralization at Cerro Aeropuerto appears to be an extension of the same hydrothermal system encountered further north at the La Luz mine. Interest in this prospect was sparked by anomalous surface samples and based on the results of one RC drill hole completed in 1998. Follow-up work included the collection of surface geochemical samples, the excavation of four trenches, and drilling of 3,230.2m in nine diamond drill holes. Significant drill intercepts related to structural zones containing pyrite, chalcopyrite, sphalerite and native gold in quartz-carbonate veins were encountered. This drilling by Yamana returned numerous significant drill intercepts including 5.10 g/t Au over 4.30 m, 6.57 g/t Au over 18.0 m, 4.62 g/t Au over 15.0 m, and 5.41 g/t Au over 7.0 m. The structural zone hosting significant gold mineralization at Cerro Aeropuerto is open for expansion along strike and to depth.

Regional Gold and Copper Targets

At the regional scale, during the past two years, Yamana focussed on baseline geologic mapping, rock, soil, and stream sediment sampling through the Siuna and Rosita districts. Work concentrated largely on relocating the most prominent and historically important gold occurrences, and performing baseline-style work to better define their potential. There are over 60 reported mineral prospects within the NEN Project Concessions. A majority of the lesser known gold occurrences have seen little to no recent work.

As a result of the reconnaissance-style investigations, there is a better understanding of several highly prospective gold and copper occurrences in the Siuna and Rosita districts. Details of these targets are discussed in the below sections. In addition to large areas that have received no exploration work to date, at least five new high priority gold and copper prospects were identified in the Siuna and Rosita districts that Calibre believes can be quickly advanced for drill testing.

Epithermal Gold Targets

Exploration concessions in the eastern part of the Rosita district have historically been highlighted as prospective areas for epithermal vein gold mineralization. Activity by past workers in the region has been limited to several small-scale open pits and underground gold workings, but confirms the potential for epithermal gold mineralization in this region. Mapping and geochemical sampling identified and confirmed the presence of four separate epithermal vein systems with an estimated total combined strike-length of 18 km. Individual veins up to 12 m wide were located with grab samples returning up to 23 g/t Au. At the La Luna epithermal gold target, channel sampling in 2008 of a structurally controlled quartz vein and breccia returned 3.57 g/t Au over 12.60 m. Additional epithermal vein/skarn systems have also been identified in the Rosita district. Calibre is planning to conduct additional exploration and drilling in this highly prospective epithermal gold district in order to better understand the potential extent and size of these mineral systems.

Gold-Copper Skarn Targets

Regional geological investigations by Yamana also improved the understanding and potential of several gold-copper skarn systems in the Rosita district. The Bambana prospect, located approximately 4 km west of the historic Santa Rita mine, is one of the district's high priority gold-copper targets. Although there is evidence of some past production in a small open pit, recent work identified two zones of coincident gold-copper skarn mineralization. Potassic, argillic, and silicic alteration is defined over a strike-length of more than 1.0 km, and in some areas is coincident with oxide copper mineralization at surface. Fifty-nine rock samples were collected from this prospect with samples returning up to 19.3 g/t Au, 1,270 g/t Ag, 16.6% Cu, 3.9% Pb, and 6.5% Zn. Mineralization in the east zone has been traced over an approximate area of 150 m by 300 m and in the Open Pit zone over an area approximately 200 m by 200 m. Based on the limited amount of work and favourable results to date from prospects such as Bambana, Calibre intends to assess and advance a number of these high priority gold-copper skarn targets.

The technical content in this news release was read and approved by Douglas Forster, M.Sc., P.Geo, Chairman of Calibre Mining Corp. Mr. Forster is a professional geoscientist registered in the Province of British Columbia and is a qualified person as defined by NI 43-101.

Calibre Mining Corp. is a TSX Venture Exchange listed company (TSX.V: CXB) that is focused on the acquisition, exploration and development of gold and copper deposits in North and Central America.

On behalf of the Board of Directors

"Robert Brown" CEO and President

For further information contact:

Robert Brown - Vancouver, Canada

604 681 9944

www.calibremining.com

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

The views and information expressed in this news release are those of Calibre's management based on its due diligence to date and to its knowledge including the review of historic information obtained from internal company reports. No representations as to the accuracy of the information outlined in this news release have been made (nor should any be assumed to have been made) by any of the companies named herein.

Cautionary Note Regarding Forward Looking Statements

Safe Harbor Statement under the United States Private Securities Litigation Reform Act of 1995: Except for the statements of historical fact contained herein, the information presented constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements including but not limited to those with respect to the price of gold, silver or copper, potential mineralization, reserve and resource determination, exploration results, and future plans and objectives of the Company involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Calibre Mining Corp. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.