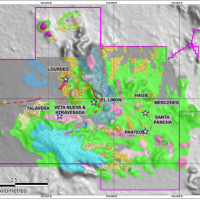

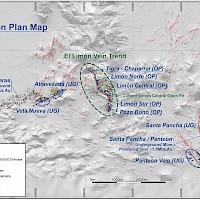

The El Limόn mining exploitation permit covers an area of 12,000 ha and was granted by Ministerial Decree for a 25-year term in 2002. The project also comprises the Bonete-Limόn, Guanacastal III, San Antonio, and Guanacastal II exploration permits, which are contiguous with the exploitation permit and cover a total area of 8,147 ha, and Villanueva 2 exploration permit, which is located 12 km north of the exploitation permit and covers an area of 1,200 ha.

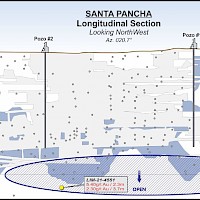

Mining operations use conventional open pit mining methods at the Limón Central open pit and a combination of top-down and bottom-up sequenced longitudinal open stoping ("LOS") at the Santa Pancha underground mines. The El Limón processing plant consists of agitated cyanide leaching and carbon adsorption, followed by carbon elution, electrowinning, and doré production. The annual throughput is approximately 500,000 tonnes per annum ("tpa") and the historical recovery is 94% to 95%.

Calibre’s asset base includes multiple ore sources, 2.7 million tpa of installed mill capacity from two processing facilities (El Limon and La Libertad), reliable in-country infrastructure, and favourable transportation costs. The Company will continue to optimize its consolidated mine and process plans as the Company progresses our “hub-and-spoke” approach to maximizing value from our integrated asset base.

EL Limon Resource Expansion and Discovery Opportunity

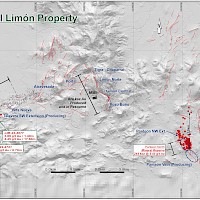

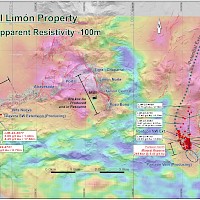

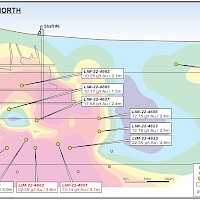

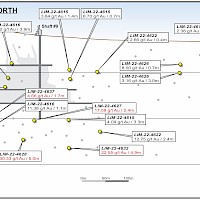

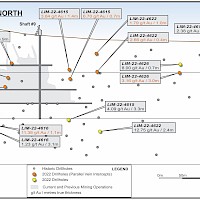

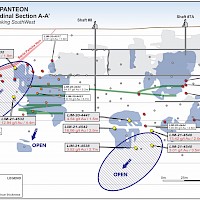

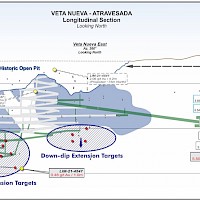

Calibre has an extensive ongoing exploration program focused on resource expansion and discovery potential within the Limon Complex. Calibre has multiple rigs operating within the Limon mineral concessions including two active rigs carrying out step-out drilling along the multi-kilometre, high-grade Panteon VTEM Gold Corridor following the successful 2022 drilling campaign that resulted in the discovery of the high-grade Panteon North gold shoot which hosts a maiden Mineral Rserve of 244,000 ounces of gold (0.8MT at 9.45 g/t gold). In addtion, there is an active drill program at the past producing Talavera mine, now known as the Talavera extension, which, historically, produced 800,000 ounces of high-grade ore and is not yet included in the Company's Mineral Resources. First pass drilling is underway at the recently permitted Buena Vista concessions located near the Limon Complex. To date, Limon hosts a combined open pit and underground Mineral Reserve of 3.7 million tonnnes grading at 5.50 g/t gold containing 657,000 ounces of gold.

- The Project consists of five contiguous blocks covering an aggregate area of 20,147 ha

- El Limόn mining exploitation permit covers an area of 12,000 ha

- Reliable in-country infrastructure, and favourable transportation costs

- Disciplined process underway to optimize mine & process plans through a “Hub-and-Spoke” approach

- Limon Process Plant (Name Plate Capacity): 500,000 tpa