Vancouver, British Columbia: Calibre Mining Corp. (TSX-V: CXB) (the "Company" or "Calibre") is pleased to report that initial rock and soil geochemical data from the Borosi gold-silver-copper project area in northeast Nicaragua have been received from ALS CHEMEX labs of North Vancouver BC. Sampling results from the La Luna, Blag and Riscos de Oro targets within the Eastern Epithermal Camp have outlined four new low-sulphidation epithermal gold-silver vein trends.

"The discovery of four new epithermal gold-silver vein systems on the Borosi project after our initial two month sampling and mapping program is quite encouraging and validates our interpretation that the Eastern Epithermal Camp may host significant epithermal vein systems," Robert Brown, President and CEO of Calibre stated. "These new targets represent only a fraction of over twenty gold-silver-copper targets that Calibre is evaluating on the Borosi project. The current target delineation program will culminate in a planned multi-rig, 6000 metre drill program beginning in the first quarter of 2010."

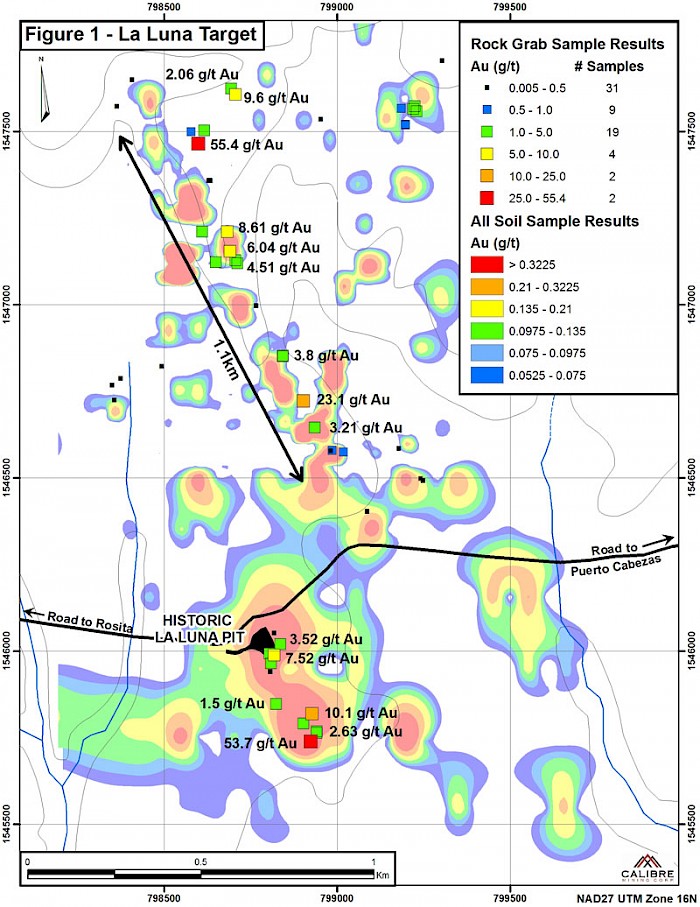

At La Luna (Figure 1), Calibre completed 8.4 line-km of infill soil sampling that when combined with historic soil data, outlined a 2200 metre anomalous gold-in-soil trend that bisects the concession. Within this anomalous gold-in-soil trend, a new 1100 metre by 50 metre zone of low-sulphidation style epithermal quartz veins and quartz breccias was delineated. Mineralization along this epithermal vein trend was defined by 23 rock grab samples returning an average gold grade of 5.6 g/t Au with one sample grading 55.4 g/t Au. In addition to gold, these samples returned an average silver grade of 7.5 g/t Ag and up to 436 g/t Ag.

At Blag, partial results of 70 rock grab samples combined with historic soil coverage identified two new zones containing epithermal quartz veins. The western zone contains anomalous samples in an area 900 metres by 300 metres while the central zone is defined over an area 200 metres by 250 metres. Gold assays from 51 samples of andesite, quartz vein and quartz vein breccia within these two zones yielded an average gold grade of 1.65 g/t Au and up to 50.3 g/t Au with silver values of up to 1200 g/t Ag.

At Riscos de Oro, results from a 5.5 line-km reconnaissance soil sampling program identified a northeast-trending 700 metre long by 200 metre wide mercury trend northwest of the historic Riscos de Oro mine. The trend is open to the southwest and northeast and is sub-parallel to the Riscos de Oro vein. The newly discovered zone contains numerous samples of chalcedonic and banded quartz veins that are coincident with a mercury anomaly high. This newly discovered zone is interpreted to represent the upper portions of a low-sulphidation epithermal precious metal system which may possibly preserve veins at depth.

Each of the newly discovered, open-ended vein trends are currently being trenched and sampled, further results will be released when received. Results from the soil, rock and trenching programs will be used to further delineate targets for the planned 6,000 m drill program, scheduled to begin in the first quarter of 2010.

The exploration program at Calibre's Borosi Gold-Copper-Silver Project is being funded by B2 Gold Corp ("B2 Gold") whereby B2 Gold can earn a 51% interest in the project by funding $8.0 million in exploration expenditures over a 3 year period. The Borosi exploration budget through July 2010 is $2.5 million. Calibre is the project operator.

Quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the soil and rock sample strings. Samples are placed in sealed bags and shipped directly to ALS CHEMEX labs in North Vancouver BC for gold fire assay and ICP multi element analyses. The technical content in this news release was read and approved by Alan Wainwright, Ph.D. P.Geo. Dr. Wainwright is a professional geologist registered in the Province of British Columbia and is a qualified person as defined by NI 43-101.

Calibre Mining Corp. is an aggressive, well financed, TSX Venture Exchange listed company (TSX.V: CXB) that is focused on the acquisition, exploration and development of gold and copper deposits in Central America. Major shareholders of Calibre include gold producers Yamana Gold Inc. and Kinross Gold Corp.

On behalf of the Board of Directors

"Robert Brown" President and CEO

For further information contact:

Robert Brown - Vancouver, Canada

604 681 9944

www.calibremining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

Safe Harbor Statement under the United States Private Securities Litigation Reform Act of 1995: Except for the statements of historical fact contained herein, the information presented constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements including but not limited to those with respect to the price of gold, silver or copper, potential mineralization, reserve and resource determination, exploration results, and future plans and objectives of the Company involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of Calibre Mining Corp. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Four New Epithermal Gold-Silver Vein Systems Delineated At Calibre's Borosi Gold-Copper Project

Dec 10, 2009