Centrado en el prolífico distrito minero de Nicaragua

- Marco legal claramente definido para la industria minera y leyes modernas

- La producción histórica de oro consolidada de B2Gold en las minas de oro El Limón y La Libertad supera los 1.4 millones de onzas

- Producción de oro multi-activos, 100% propia y operada, de las minas de oro El Limón, La Libertad y Pavón

- Amplio potencial de exploración

- El distrito de Borosi ha producido más de 7.9 millones de onzas de oro

- Operamos en el país desde hace más de 10 años

Why Invest in Calibre?

Calibre Mining is undergoing a transformational shift, advancing from the completion of construction to the production phase at its Valentine Gold Mine in Newfoundland & Labrador. At the same time, an extensive 170,000 metre exploration program across all of its assets is yielding promising results that could have positive impact on the 2024 Mineral Resource statement, supporting the Company’s continued organic growth. Below are some key highlights from recent developments:

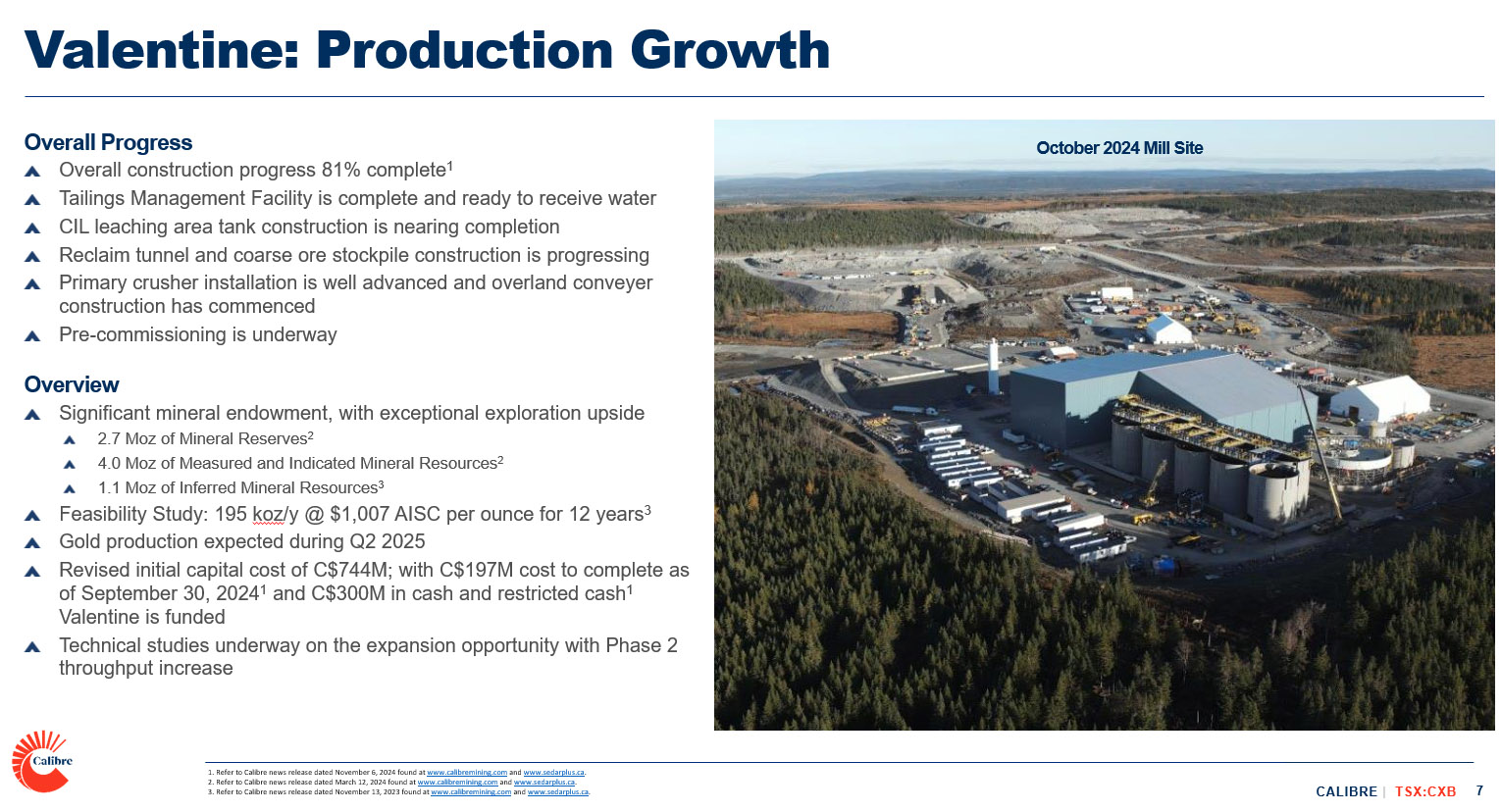

- Valentine gold mine has surpassed 81% completion with a remaining cost to complete of $197M (September 30, 2024)

- Valentine is on track for gold production in Q2 2025 (September 30, 2024)

- Drill results at Valentine have returned results that have yielded higher gold tonnes and grades than modelled in the 2022 Mineral Reserve statement

- Drill results at our Nicaraguan mine complexes as well at our Pan mine in Nevada continually return high grade gold mineralization and new discoveries, demonstrating the vast potential of these assets to grow resources and expand mine life

- Q4 2024 will be the strongest quarter of the year in terms of production, delivering 70,000 – 80,000 ounces of gold for the quarter as well as a stockpile build of 30,000 ounces which will be processed in 2025

- The Company has a healthy balance sheet with approximately CAD$300M in cash and restricted cash (September 30, 2024) and an additional $55M (November 06, 2024) to be received from a gold prepayment agreement as we fully fund the Valentine build and ongoing exploration activities

Calibre is is equipped with an elite management team with a history of mining excellence that has collectively led to the successful sale of seven mining companies exceeding $5 Billion in value. Calibre is a unique blend of stability and significant growth potential, making it a compelling opportunity for investors.

Record Results and Strategic Acquisitions

Calibre has consistently delivered results in the Americas, showcasing its capability to increase gold production while maintaining attractive margins. This operational excellence, coupled with strategic acquisitions such as the 2024 transaction with Marathon Gold acquiring 100% of the multi-million ounce Valentine Gold Mine, Calibre is positioned for great success.

Undervalued Compared to Peers

Despite Calibre's numerous achievements and delivery of commitments, Calibre trades at a significant discount to its peers, offering investors a unique entry point into a company with proven potential and a robust growth trajectory. Calibre's strategic positioning and operational efficiency present an undervalued opportunity relative to the estimated value per ounce gold in our reserves.

The Calibre Advantage

Calibre Mining offers more than just exposure to gold. It provides the unique advantage of backing a company with:

- Dynamic Growth Potential: Calibre's performance speaks volumes about its growth potential and operational excellence.

- Strategic Acquisitions and Partnerships: Our recent acquisitions and the addition of industry veterans to our team signal our commitment to strategic growth and operational excellence.

- Sustainability and Responsibility: As an industry leader in ESG, Calibre is dedicated to responsible mining practices, ensuring long-term value creation for all stakeholders.